Trump Intel CEO Resignation: Pressure and Boardroom Clashes

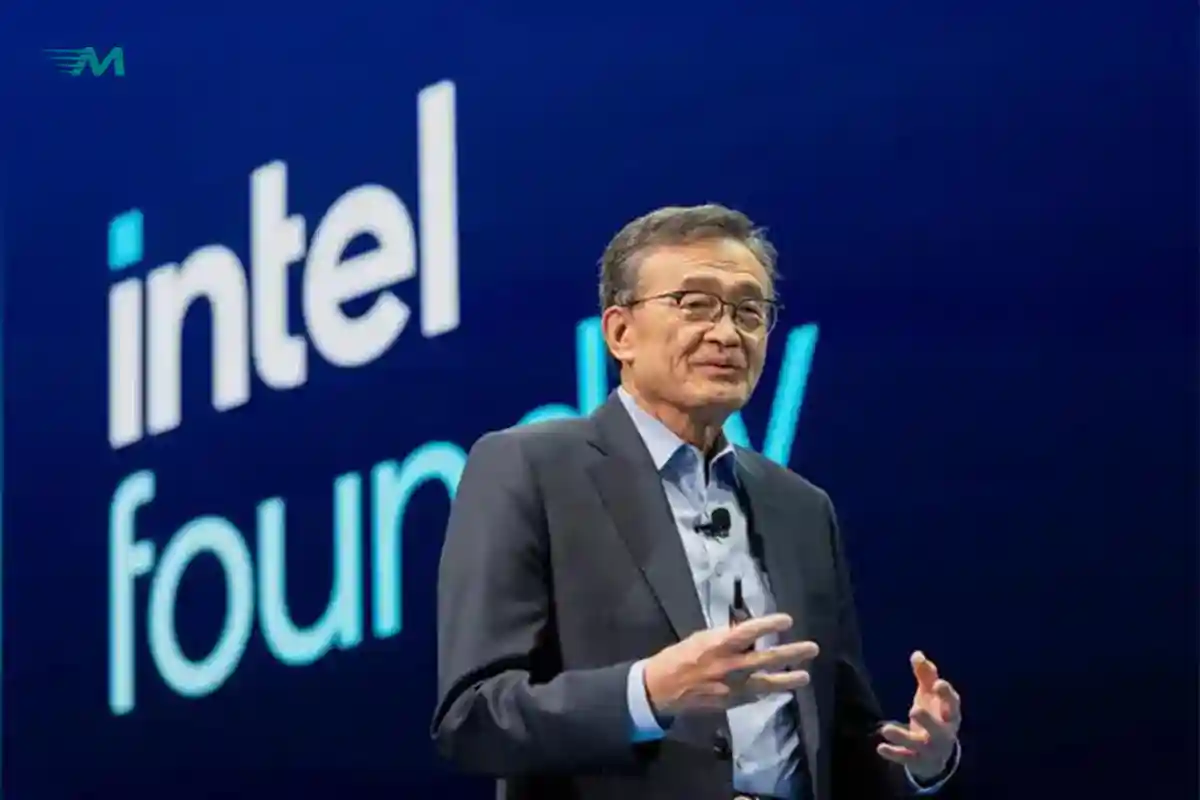

1. Trump’s Shocking Demand

On August 8, 2025, former U.S. President Donald Trump publicly called for the immediate resignation of Intel CEO Lip-Bu Tan, claiming he was “highly conflicted” due to his alleged deep business ties with China. The comments, made on social media and in interviews, rattled markets and sent Intel shares tumbling by nearly 3–3.4% within hours. The Trump Intel CEO resignation demand was a continuation of his increasingly tough stance on U.S. companies he believes are compromising national interests.

2. National Security Concerns

Trump’s demand didn’t come out of the blue. Earlier, Republican Senator Tom Cotton had sent a letter to Intel’s board questioning Tan’s past investments and connections to Chinese companies, some of which allegedly had links to China’s military. Cotton argued that these ties could pose a threat to U.S. national security and technological dominance, especially in the sensitive semiconductor sector. His warning intensified the political spotlight on Intel’s leadership.

3. Intel’s Response: Defending Its Leader

Intel swiftly issued a statement defending both the company and its CEO. The board reaffirmed its confidence in Tan’s leadership and emphasized Intel’s commitment to U.S. economic and national security interests. They highlighted ongoing efforts to expand domestic semiconductor manufacturing and reduce reliance on foreign supply chains. While the defense was strong, the public nature of Trump’s attack meant that Intel could not simply ignore the controversy.

4. A Boardroom Already Divided

The Trump controversy has come at a time when Tan was already facing internal resistance. Since taking over as CEO in March 2025, he has introduced aggressive strategic changes including significant workforce reductions, divestment of non-core business units, and a renewed focus on Intel’s core chip manufacturing business. While some board members supported these moves as necessary for survival, others feared they were too risky and could harm innovation in the long run.

5. Tan’s Past: Achievements and Controversies

Before joining Intel, Lip-Bu Tan served as CEO of Cadence Design Systems, where he was credited with driving major growth. However, Cadence also faced a U.S. export control violation case during his tenure, resulting in a $140 million settlement. Critics argue that incidents like these cast doubts over his judgment in navigating regulatory and geopolitical risks. Supporters counter that his experience and global business network are exactly what Intel needs during this highly competitive era in chipmaking.

6. Investment Links Under Scrutiny

Tan is also a well-known venture capitalist with investments in numerous technology companies worldwide, including in China. Several of these companies operate in advanced tech sectors that could be relevant to national defense. Reports from Bloomberg and Reuters noted that his investment history and relationships with Chinese tech entrepreneurs have fueled concerns among U.S. policymakers. While none of these investments have been proven to violate U.S. law, the perception of conflict is proving politically damaging.

7. Stock Market Reaction

The market response was swift and sharp. Following Trump’s remarks, Intel’s stock fell by over 3%, reflecting investor uncertainty about the company’s leadership stability. Analysts pointed out that prolonged political and boardroom tensions could hurt Intel’s strategic initiatives, delay decision-making, and potentially weaken its position against rivals like TSMC, Samsung, and NVIDIA. For investors, the leadership question has now become as important as Intel’s technology roadmap.

8. Intel’s Strategic Crossroads

Tan’s leadership strategy has been clear streamline operations, focus on core strengths, and invest heavily in U.S.-based chip manufacturing facilities. He has also scaled back on some non-essential divisions, including parts of Intel’s AI and automotive chip units, to redirect resources toward competitive semiconductor technologies. However, these moves have not been without controversy, as critics argue that scaling back on emerging technologies could limit Intel’s growth potential in the next decade.

9. Can Tan Survive the Pressure?

For now, Tan retains the backing of Intel’s board, and the company has reiterated its confidence in him. However, political pressure from a figure like Trump is difficult to ignore, especially with the 2024 U.S. presidential election looming and the potential for policy shifts that could directly impact Intel’s global operations. If shareholder confidence continues to decline, or if further revelations about Tan’s business ties emerge, his position could become untenable.

10. The Bigger Picture

The clash between Trump, Intel’s leadership, and the company’s board underscores a broader truth: technology CEOs today must navigate not only business challenges but also complex geopolitical and political landscapes. In an era where semiconductors are considered as critical as oil, leadership decisions are closely watched not just by investors, but also by governments and global markets.

Intel’s situation highlights the growing intersection of technology, national security, and political influence. The outcome of this leadership struggle could have lasting effects on the U.S. semiconductor industry and the nation’s ability to compete with China in critical technologies.

Final Takeaway:

Lip-Bu Tan’s leadership is now under dual assault external pressure from political heavyweights like Trump and internal division within Intel’s board. Whether he can hold on will depend on his ability to reassure both markets and policymakers that Intel’s future lies firmly aligned with U.S. national interests. In the high-stakes world of semiconductors, leadership stability may be as vital as innovation itself.