What Is the Stock Market? A Beginner’s Guide

The stock market can be intimidating, but just like all important things, if you boil it down then it is an integral part of the economy. In stock market for beginners guide, it will explain what the stock market is, how the stock market works and a brief overview of why the stock market is important. In this post, I have covered how to get started with investing, or, if you’d rather than learn what’s going on in the market, it will do that too.

Table of Contents

Introduction: What Is the Stock Market?

Defining the Stock Market:

Stock market is associated with stocks (equity shares of a company) bought and sold. It is essential to the global economy: companies of all sizes need capital to grow and investors require opportunities to grow their money.

Importance of the Stock Market:

- Allows capital and investment poured into businesses come from the sale of stocks so as to help businesses to innovate and expand their operations.

- It acts as a barometer of the economy, as the stock market is a reflection of the investor’s point of view and is a snapshot of the economy’s health.

- This allows companies to make money by selling their shares to the public: through IPO (Initial Public Offering), granting the company a chance to get the capital it needs to drive the future.

Types of Markets:

- Stocks are issued First time to the public in a new form in the Primary Market.

- It is also called the secondary market because it is involved with buying and selling of previously issued stocks.

- They can include stock exchanges like New York Stock Exchange (NYSE), NASDAQ and Bombay Stock Exchange (BSE).

How the Stock Market Works

Stock Exchanges:

Stock exchanges are the platforms where stocks are listed and traded. The most recognized exchanges around the world include the NYSE, Nasdaq, London Stock Exchange, and so on. Brokers exist to connect buyers and sellers to these exchanges; their role is to facilitate trades between two parties.

Trading Stocks:

Stocks are bought and sold through brokers via traditional or online platforms. Stock quotes are the price of the stock at present moment in time and it keeps on fluctuating based on the market condition. Stocks are very volatile because the price moves according to supply and demand.

Stock Price Movement:

There are factors which influence stock prices:

- Stock Price: The rise or fall of the stock price of a company depends on company performance. If there is positive or negative news about the company, then it might shoot up or go down.

- Investor emotions and perceptions can move prices (market sentiment).

- There are certain political events, interest rates, and bigger economic movements that can affect stock prices on a global basis.

These stock market basics will help the investors in understanding the price movement and its effects in directing their opinion.

Key Players in the Stock Market

Investors:

It is also an apex for different investors, including:

- Individuals investing their own money.

- The Large Institutional Investors include pension funds and mutual funds.

- Non professional individual investors trading in small quantities are known as retail investors.

Furthermore, it differentiates between active and passive investors (contemporary merchants and long term holders).

Stock Brokers and Dealers:

Brokers are people that are licensed to buy and sell stocks in the place of their investors. Today, with so many online trading platforms, such as Zerodha, Robinhood and E*TRADE, becoming accessible to individual investors, brokers do not necessarily have to deal with such a lofty status symbol. Helps them to execute orders but it charges its fee or commission to its services.

Regulators:

The stock market must run fairly and transparently, thus the presence of regulatory bodies like Securities and Exchange Commission (SEC) in the USA, SEBI in India, etc. They protect investors from frauds, maintain market integrity and also help investors perform due diligence on the companies before investing.

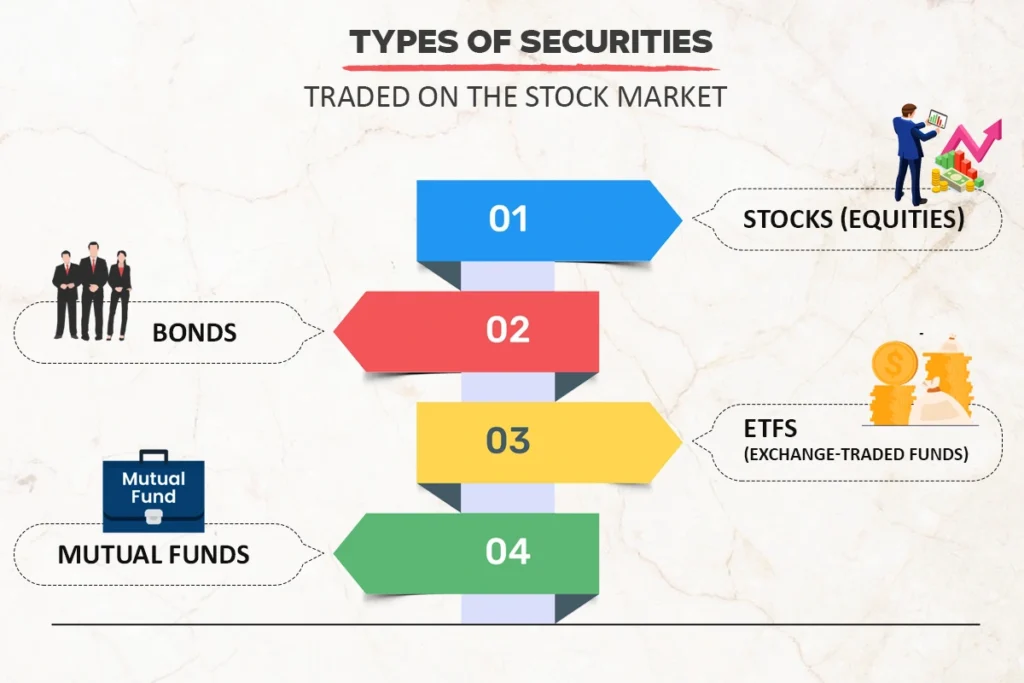

Types of Securities Traded on the Stock Market

Stocks (Equities):

Ownership of any company is what stocks represent. Preferred stockholders generally only have voting rights that are superseded by the rights of common stockholders to vote; they typically get a dividend before common stockholders. There are benefits and risks with each type of stock.

Bonds:

Companies or governments borrow money from companies. Stocks differ by their representing debt rather than ownership. Investment in bonds leads to regular interest payments to the investors, who in turn, receive the principal amount at maturity.

ETFs (Exchange-Traded Funds):

ETFs are securities that follow an index, a commodity or basket of assets. Investors are able to diversify their portfolio using ETFs in an easy way.

Mutual Funds:

They pool money from multiple investors to buy a portfolio of stocks, bonds, or other securities for them. Investing in mutual funds automatically gives access to diversification of investment across sectors and companies which provides instant diversification, thus they ease the risk involved in investment in individual stocks.

Basic Terms You Should Know

| Term | Definition |

| Stock | A share of ownership in a company |

| Stock Exchange | A marketplace where securities are bought and sold |

| Broker | A licensed professional who buys and sells stocks on behalf of investors |

| Dividend | A payment made by a company to its shareholders from profits |

| IPO (Initial Public Offering) | The first sale of stock by a private company to the public |

| Bear Market | A market where prices are falling or are expected to fall |

| Bull Market | A market where prices are rising or expected to rise |

| Blue Chip Stocks | Shares in large, well-established companies known for reliability |

Stock Market Indices

What Is a Stock Market Index?

A stock market index is a group of stocks and their overall performance. Common indices include:

- Dow Jones Industrial Average (DJIA)

- S&P 500

- NASDAQ Composite

These are the basis for measuring the performance of the broader market or sector indices.

Why Indices Matter:

The use of indices helps investors track market trends which is important when you need to establish the condition of the market or a particular industry.

Starting to Invest in the Stock Market

First of all, Select a Broker or a Trading Platform:

You should look at fees, the usability of their trading platform, their research tools, etc. Zerodha, Robinhood and E*TRADE are popular brokers.

Set a Budget:

It’s important to start small. Avoid investing money you can’t afford to lose. In the same vein, stock market returns are often located in the long term.

Diversify Your Portfolio:

It is important to diversify to avoid high risks. You can diversify by selecting different sectors, asset classes and regions.

Long-Term vs. Short-Term Investment:

- Long term investment includes buying stocks and holding on them for a few years with a faith the market will trend upwards.

- Investing for Short Term period – Buying and selling stock at short periods of time, for short term profit fantasy, which can be a risky one, considering market volatility.

Risks of Investing in the Stock Market

- Market Risk: This refers to the risk that’s caused by changes in the overall financial market, occasioned by, for instance, a drop in the economy or a recession, or a geopolitical event. Stock prices can move up or down a lot based on the volatility of the market, in temporary or permanent ways.

- Often, these market movements are unpredictable and it is the drive for investors to be able to withstand times of downturns. Although the market is usually able to rebound over time, short term volatility can often lead to substantial loss, and any investor needs an ability to withstand such periods, such as by diversification.

- This risk has to do with investing in particular companies and is reliant on the performance of the company. In certain cases, a company’s stock can underperform if that company has poor management, declining sales, or fails to innovate.

- The latter are particularly important when investing in single stocks as opposed to diversified portfolios. To avoid such risk, it helps to diversify — to place investments across various companies, sectors, and even asset types. This diversification provides some portfolio protection from the negative effects of any one company’s poor performance.

- Inflation Risk: Inflation risk is the risk to the purchasing power of your returns as prices generally rise over time. If inflation is high, your investment income may be worth less, even if your stock prices rise, as this might not go along with inflation.

- When included in a well diversified portfolio, however, stocks have a tendency to beat inflation over the long haul. However, at times of high inflation, the real yield from investments may not be what we anticipated.

- Interest Rate Risk – Interest rate risk refers to the chance that shifts in the interest rates can have a negative impact on the price of stocks. Higher interest rates relate to an increase in borrowing costs, which can slow the economy’s growth, decrease consumer spending and corporate profits. Therefore, stocks in certain sectors will drop in value.

- One group of people likely to suffer big losses in investors are those holding bonds, since the value of these assets tends to decrease when interest rates rise. However, stocks can be sensitive as well to the interest rate increases, particularly among interest sensitive industries such as real estate and financials, as well as utilities.

- Currency Risk: This arises when one invests in international stocks or assets. Also, the value of the foreign investments can decrease if the value of a foreign currency decreases in relation to your home currency.

- Suppose you have a European company’s shares and the euro declines relative to your home currency, the value of your investment converted into your home currency will be reduced. This is especially useful for foreign investors because it can be reduced via currency hedging or investment on domestic ventures.

- Political risk: Political risk is uncertainty around political systems including government policies, regulation, leadership, which impacts the business environment. The risks to investments can take many forms, including changes in the taxation policy, new legislations, robotics of industries, as well as political unrest in isolated territories.

- For instance, if a country implements trade restrictions or sanctions, then it would also negatively impact the company’s profitability which depends on international trade. Investing in emerging markets or areas with shaky political climates is particularly hazardous regarding political risk.

FAQs

1. What is the minimum amount I need to start investing in the stock market?

You can start with as little as a few hundred dollars, depending on the broker.

2. How do I choose the right stock for my investment goals?

Research different companies, understand their performance, and align your choices with your financial goals.

3. Can I lose all my money in the stock market?

While it’s possible to lose money, diversification and a long-term approach can help mitigate risks.

4. How often should I review my stock portfolio?

It’s a good practice to review your portfolio at least once a year, adjusting based on your financial goals.

5. What are the tax implications of investing in stocks?

Depending on your country’s tax laws, profits from stocks might be subject to capital gains taxes.

6. How do stock prices fluctuate so quickly?

Stock prices fluctuate due to changes in demand and supply, news, and overall market sentiment.

7. What is a dividend?

A dividend is a portion of a company’s earnings distributed to its shareholders as a reward for their investment.

8. What is the difference between a stock and a bond?

A stock represents ownership in a company, while a bond is a loan made to a company or government that pays interest.

9. What is a bull market?

A bull market refers to a period when stock prices are rising or are expected to rise.

10. What is a bear market?

A bear market refers to a period when stock prices are falling or are expected to fall.

11. What are blue-chip stocks?

Blue-chip stocks are shares in large, well-established companies known for their reliability and stable returns.

12. What are ETFs?

Exchange-Traded Funds (ETFs) are investment funds that track a specific index, sector, or commodity, offering a diversified portfolio.

Conclusion: Getting Started in the Stock Market

Key Takeaways:

It is a fundamental part of the economy that provides companies with an avenue to raise capital and for investors to build up their wealth. By understanding stock market basic concepts, terminology and risks in the stock market, you will be better positioned to participate in the stock market.

The first step is to research and pick out a broker today. Start by investing small amounts and increasing that as you build your portfolio. Keep it consistent and understand that investing is a game for the long run.