Tips and Best Ways to Enhance Cash Flow in Your Company

The health of a company depends on its Cash Flow in Your Company. For a startup, a family firm or a big enterprise, controlling your business’s cash flow is necessary for managing daily activities, future progress and finances. You will learn about techniques and rules that have been proven to support cash flow here.

Table of Contents

1. Why cash flow is an essential part of business.

Cash Flow in Your Company means the total amount of cash and cash equivalents moving in and out of a business. If a company has positive cash flow, its liquid assets go up, letting the company clear its debts, invest further, pay dividends to shareholders and guard against financial risks ahead.

To manage financial operations in your business well, you should be able to cover short-term expenses and support your long-term strategy without trouble.

2. Comprehending the key parts of Cash Flow

There are three basic kinds of cash flow.

- Operating Cash Flow means the cash your company earns from carrying out its normal operations.

- Cash used by a business to buy things like equipment or property is called Cash Flow for Investing.

- Money is gathered by borrowing from investors or financial institutions or by using it to refund debt.

If you want to assess your business’s cash flow, begin with operating cash flow, since it is the best indicator of how strong your finances are.

3. Usual Factors Leading to Cash Flow Problems

There are many possible reasons for cash flow challenges. These are some of the most usual reasons why this happens:

- Customers paying their bills late

- Too many products in the warehouse

- The costs needed to operate are too high and must be paid no matter how busy the business gets.

- A flawed approach to pricing

- Poorly created financial outlook

Getting to the heart of the matter is the first thing to do when improving your business’ cash flow.

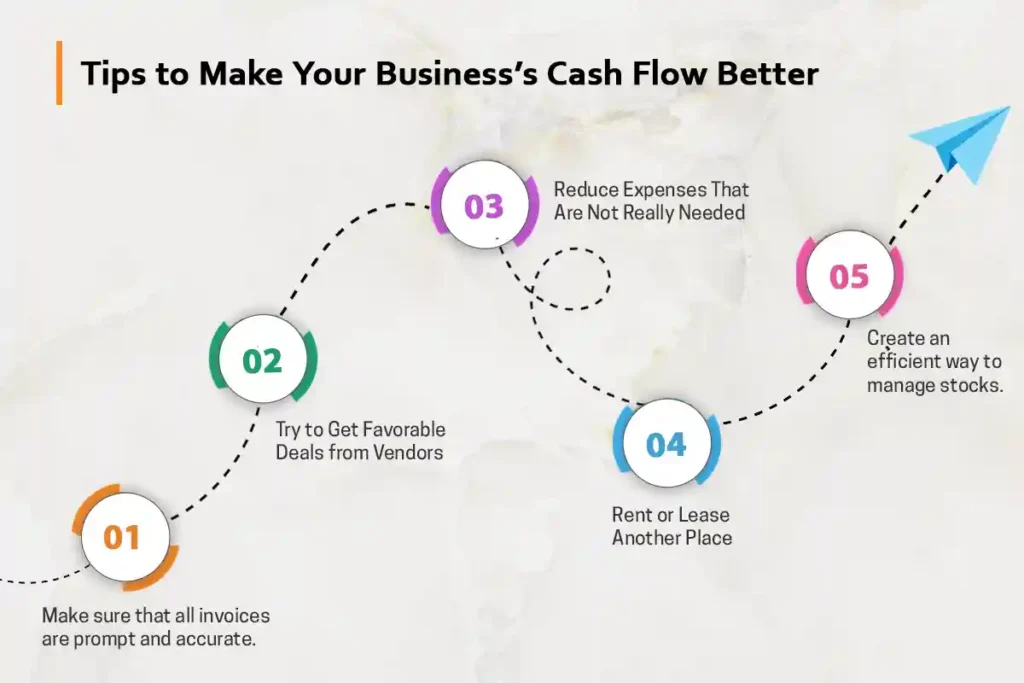

4. Tips to Make Your Business’s Cash Flow Better

The following ideas are ways you can manage cash flow better in your business.

a) Make sure that all invoices are prompt and accurate.

Make use of software that generates invoices automatically and ensures that there are no mistakes in billing. Offer special rates to people who pay promptly and never fail to follow up on payments that are overdue.

b) Try to Get Favorable Deals from Vendors

Keep in touch with your suppliers to find out if they are willing to extend your payments, making sure your partnership is not affected. There is more time to turn the inventory into sales before you must pay for it.

c) Reduce Expenses That Are Not Really Needed

Review what you spend each month and try to reduce unimportant costs. You may want to lower your spending by using cheaper versions or renegotiating your service agreements.

d) Rent or Lease Another Place

With leasing, businesses might need less cash at the start and can still save their money for other things.

e) Create an efficient way to manage stocks.

Do not buy too much inventory by using up-to-date inventory tracking methods. Put slow-selling goods on sale to get more cash for your business.

5. Best Techniques for Controlling Cash Flow

Adjust your financial methods by following the traditional recommendations to boost your business’s cash flow.

a) Make sure to store a reserve of cash.

Make sure you have a financial cushion to deal with sudden expenses or a weak economic period.

b) Make Monthly Cash Forecasts

It is helpful to forecast your cash flow for the next few months so you spot when money might be low or high.

c) Keep personal money different from business money.

Make sure that your personal and business costs do not mix. This way, the company’s records are tidier and the budgeting process is easier.

d) Create a Cash Flow Policy

Decide on how you and your partner will deal with spending, collections and payments together. Teach staff how to follow this policy.

6. Employing Technology to Keep Track of and Estimate Cash Movement

There are different tools that let you automate, watch over and check the flow of your business cash.

- Accounting software like QuickBooks or Zoho Books

- Cash flow forecasting tools like Float, Pulse, or PlanGuru

- Inventory management systems for real-time visibility

- Payment processors that offer faster transaction settlements

With digital methods, the work required is less and financial plans are made more precisely.

7. Examples of success stories in the field

Explanation for case study one: a retail store in the city of Bangalore

Switching to a just-in-time inventory approach and electronic invoicing made it easier for the retail clothing store to manage their cash flow. The amount of cash tied up in inventory dropped and payments from clients came in faster.

Focuses on a manufacturing firm located in Gujarat.

They worked out new payment plans with their suppliers and chose installment billing for customers. Therefore, they managed to cut their monthly remaining balance by half.

8. You should stay away from these cash flow management errors.

You can manage your business’s cash flow better by avoiding these common problems:

- Not paying attention to cash flow statements: Net profit tells us little about a company’s access to liquid funds.

- People can lose money from debt when interest costs are very high.

- Neglecting to prepare for system change: Most businesses cycle in sales when there are no peak seasons.

- If you don’t track your spending right away, you might miss some details that can change the accuracy of your budget.

- Having low cash reserves makes a company more at risk since there is not much extra money to help during challenges.

9. Longevity strategies for continuing cash flow

You shouldn’t rely solely on brief measures to help your business. It is necessary to improve the structure of the building.

a) Make sure you have several ways to make money.

Earning money through several ways makes your finances stronger and more consistent.

b) Use Subscription/Recurring Business Approaches

Regularly sending out bills helps you receive money at regular schedules.

c) Increase the number of customers who stick with the company.

People who stick with you often do repeat shopping while still caring about their payment deadlines.

d) Regular financial audits should be performed in your business.

Audit the company to find areas where cash is being wasted and deal with the problems.

e) Hand over non-essential functions to third parties.

By outsourcing these aspects, companies can lower their spending.

10. Improve Your Business by Keeping Cash Flow High

Maintaining steady cash flow is critical for any business and cannot be ignored. Regardless of what you do daily or in the future, adequate cash flow helps your company evolve, earns you a good reputation and allows you to handle uncertainties.

To start, monitor your income and expenses, manage your invoicing well, cut down on unnecessary buying and make use of modern technology. As time goes by, regularly taking these actions will improve your company’s ability to prosper financially and grow.

When you manage cash flow well, you need to look beyond earnings and use what you already have wisely.

FAQ

What is the most effective way to improve cash flow in your business?

Reducing expenses and accelerating receivables are key to improving cash flow in your business.

How often should you monitor cash flow in your business?

It’s advisable to review cash flow weekly or monthly for optimal control.

Can technology help manage cash flow in your business?

Yes, tools like accounting software and cash flow forecasting apps can greatly streamline management.