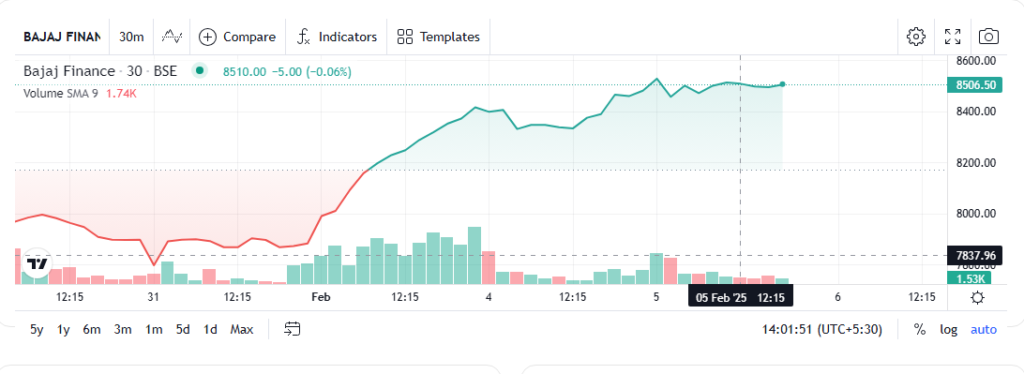

Bajaj Finance Shares Hit Record High of ₹8,440 Intraday

The Indian stock market witnessed a major milestone as Bajaj Finance shares surged to an all-time high of ₹8,440 during intraday trading. This rally reflects strong investor confidence in the company’s growth potential, supported by a robust financial performance and a favorable economic environment. The rise in Bajaj Finance share price has sparked excitement among traders and long-term investors alike.

With Bajaj Finance shares today showing remarkable strength, many factors have contributed to this upward momentum, including expectations around Budget 2025, rising consumer demand, and the overall bullish sentiment in the financial sector. Let’s explore the reasons behind this surge and what it means for investors.

Why Bajaj Finance Hits Record High?

Strong Q3 Earnings & Business Growth

- Bajaj Finance recently reported strong quarterly earnings, with a significant rise in net profit and asset quality improvements.

- The company has expanded its loan portfolio, particularly in retail and SME segments, leading to higher revenue generation.

- A lower non-performing asset (NPA) ratio further reassured investors about its financial stability.

Consumption Boost Driving Bajaj Finance Shares

- India’s growing consumer spending has fueled demand for credit, benefiting companies like Bajaj Finance.

- The rise in discretionary spending on electronics, automobiles, and home appliances has led to increased loan disbursals.

- Analysts believe that a consumption boost for Bajaj Finance will continue, further strengthening its financial outlook.

Expectations from Budget 2025

- Investors are anticipating policy announcements in Budget 2025 that could support financial services and lending institutions.

- Potential tax incentives, credit-linked schemes, and economic growth initiatives may further boost the demand for loans.

- The market expects favorable policies that will benefit Bajaj Finance shares, driving their price higher.

Key Factors Driving Bajaj Finance’s Growth in 2025

Strong Digital Transformation Strategy

- Bajaj Finance has significantly invested in its digital lending platform, streamlining loan approvals and customer onboarding.

- AI-driven risk assessment models have reduced bad loans while improving customer service.

- The company’s digital-first approach has positioned it well to capitalize on India’s growing fintech ecosystem.

Expansion into New Lending Segments

- Apart from traditional consumer loans, Bajaj Finance is expanding into personal loans, SME financing, and rural lending.

- Its foray into co-branded credit cards has boosted revenue streams.

- The company is targeting underserved markets to further grow its customer base.

Favorable Market Sentiment

- Investor sentiment toward NBFCs remains strong due to India’s economic recovery post-pandemic.

- Foreign institutional investors (FIIs) have been increasing their stakes in Bajaj Finance, reflecting global confidence.

- The stock’s inclusion in various market indices has also contributed to its steady growth.

What Analysts Say About Bajaj Finance Shares Today

Brokerage Ratings & Target Prices

| Brokerage | Rating | Target Price (₹) |

| Morgan Stanley | Overweight | 8,800 |

| ICICI Securities | Buy | 9,000 |

| Motilal Oswal | Buy | 8,750 |

- Analysts remain bullish on Bajaj Finance shares, citing strong fundamentals and long-term growth potential.

- Most brokerages have revised their target prices upward, indicating further upside.

Risks to Consider Before Investing

While Bajaj Finance shares continue to rise, investors should be aware of certain risks:

Rising Interest Rates

- Higher interest rates could impact loan demand and borrowing costs.

- The RBI’s monetary policy decisions will play a key role in determining future profitability.

Regulatory Changes

- Any new regulations on NBFC lending or digital transactions could affect operations.

- Stricter compliance requirements may slow down loan disbursement.

Competition from Fintech & Banks

- Rising competition from digital lenders and banks could affect Bajaj Finance’s market share.

- New-age fintech startups are offering AI-driven lending solutions, posing a potential challenge.

Future Outlook: Will Bajaj Finance Shares Continue to Rally?

Budget 2025 Expectations

- Market experts predict that Budget 2025 will focus on financial inclusion and digital banking, benefiting NBFCs.

- A boost in government-backed credit schemes could enhance Bajaj Finance’s lending business.

Growth in Loan Demand

- As India’s economy expands, the demand for personal loans, business loans, and consumer credit will increase.

- Bajaj Finance’s strong market presence positions it well to capitalize on this growth.

Stock Price Predictions

- If current momentum continues, Bajaj Finance share price could cross ₹9,000 in the coming months.

- Long-term investors can benefit from compounding returns if they hold the stock through economic cycles.

Conclusion

The recent surge in Bajaj Finance shares today highlights investor confidence in the company’s strong fundamentals and growth potential. As Bajaj Finance hits a record high, factors like a consumption boost, digital expansion, and expectations from Budget 2025 are driving its upward trajectory.

With positive analyst ratings and strong financial performance, Bajaj Finance share price is likely to remain on an upward path. However, investors should stay informed about market risks and economic trends before making long-term commitments. For those looking to invest in a high-growth financial stock, Bajaj Finance remains a top contender.

FAQs

1. Why did Bajaj Finance share price hit a record high?

The stock surged due to strong earnings, a rise in consumer spending, and expectations of favorable policies in Budget 2025.

2. Is Bajaj Finance a good stock to buy in 2025?

Yes, analysts are bullish on Bajaj Finance shares due to its strong digital strategy, expanding loan portfolio, and financial stability.

3. How does Budget 2025 impact Bajaj Finance shares?

If Budget 2025 includes policies favoring NBFCs, digital lending, and financial inclusion, it could further boost Bajaj Finance share price.